QuantRocket 2.0 is now available, with minute data for US stocks, Zipline live trading, new broker support, new data providers, and more.

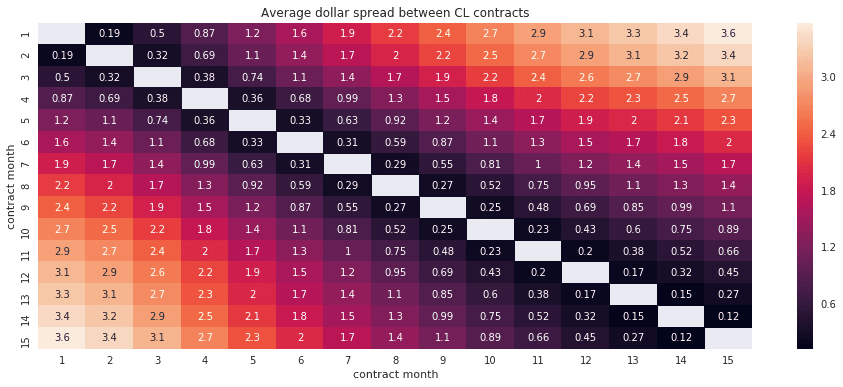

Intraday Futures Calendar Spreads and the Impact of Transaction Costs

Wed Sep 25 2019

Intraday trading strategies offer great promise as well as great peril. This post explores an intraday trading strategy for crude oil calendar spreads and highlights the impact of transaction costs on its profitability.

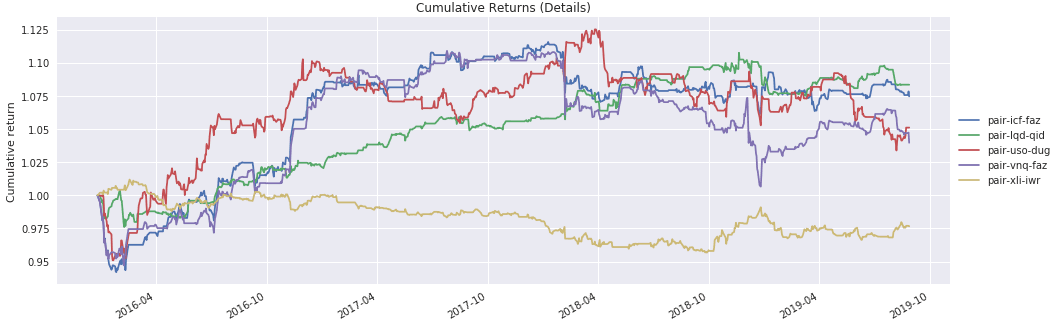

Is Pairs Trading Still Viable?

Fri Aug 30 2019

Classic pairs trading strategies have suffered deteriorating returns over time. Can a research pipeline that facilitates the identification and selection of ETF pairs make pairs trading viable again? This post investigates such a pipeline.

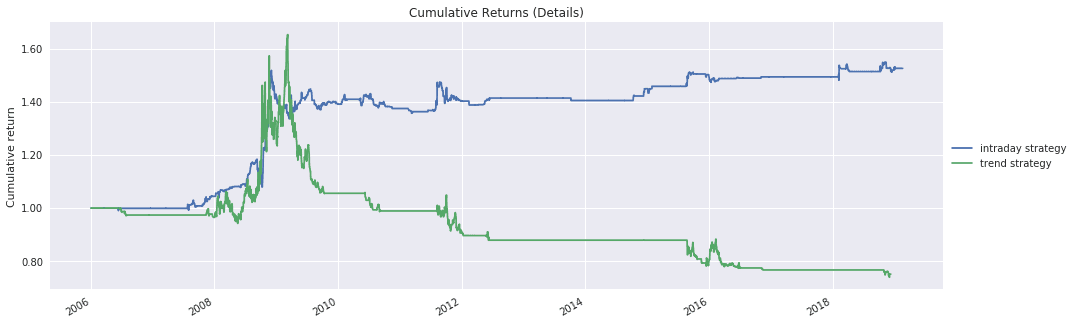

Hedging Long-Term Risk with an Intraday Strategy

Tue Mar 19 2019

Do intraday strategies have a place in the portfolios of long-term investors and fund managers? This post explores an intraday strategy that works best in high volatility regimes and thus makes an attractive candidate for hedging long-term portfolio risk.

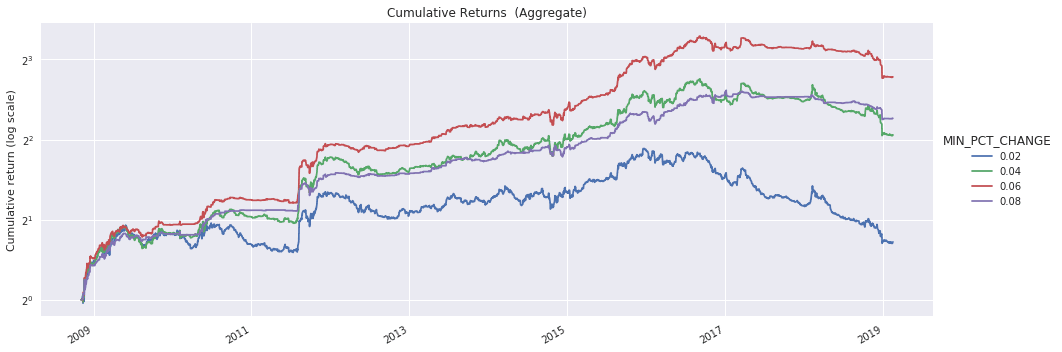

Intraday Momentum with Leveraged ETFs

Tue Mar 05 2019

Does forced buying and selling of underlying shares by leveraged ETF sponsors cause predictable intraday price moves? This post explores an intraday momentum strategy based on the premise that it does.

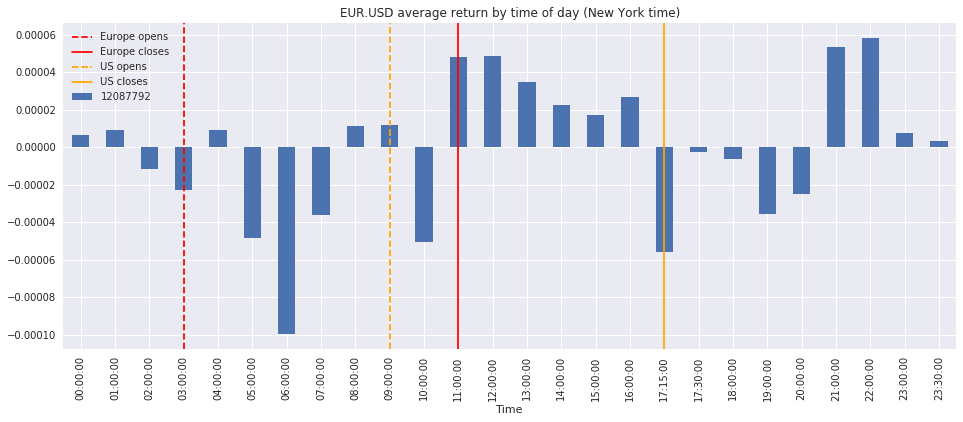

Exploiting Business Day Patterns in FX Markets

Mon Feb 18 2019

Do businesses exchange currencies in predictable ways that FX traders can exploit? This post explores an intraday EUR.USD strategy based on the hypothesis that businesses cause currencies to depreciate during local business hours and appreciate during foreign business hours.

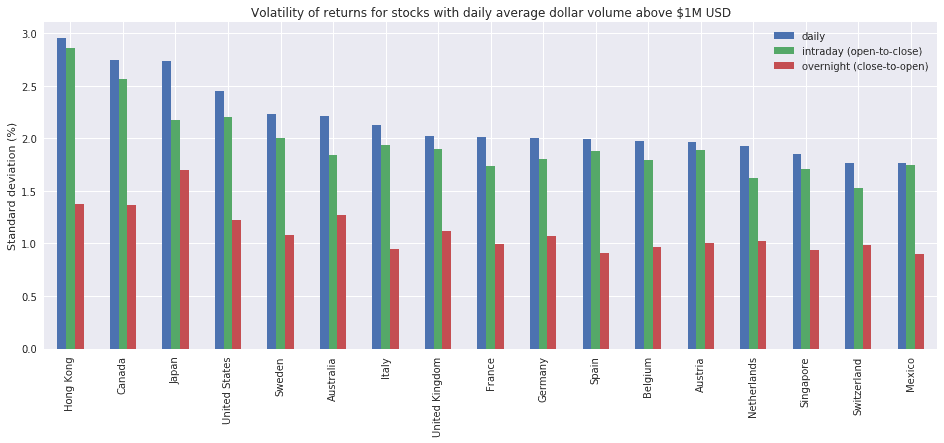

The Most Volatile Stock Markets in the World

Mon Jan 14 2019

Many quantitative trading strategies thrive in high volatility regimes, while other trading strategies work best in low volatility regimes. So which global markets are the most and least volatile? This post compares the daily, overnight, and intraday volatility of 17 countries.

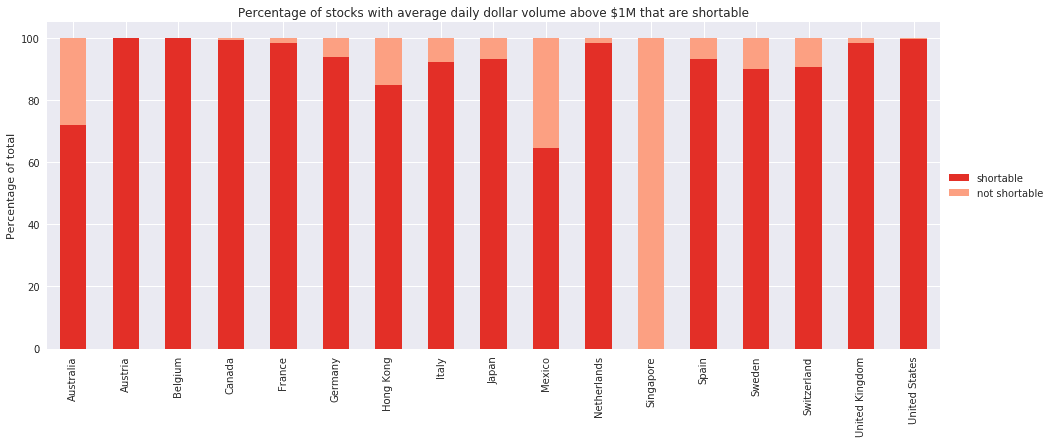

The Best Global Stock Markets for Short Sellers

Wed Jan 02 2019

If you're a short seller exploring global markets, a good first question to ask is: are there shares available to borrow? This post looks at the percentage of stocks that are shortable through Interactive Brokers in each of 17 countries.

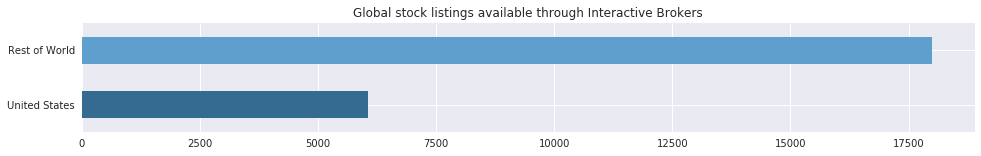

The Overlooked Half of the Global Stock Market

Mon Dec 17 2018

The US stock market is the largest and most liquid stock market in the world and tends to get all the attention. Many brokers and trading platforms are US-only, and many traders focus exclusively on the US market.

This post compares the number of stock listings in each of 17 countries to quantify what traders miss out on by ignoring the rest of the world.